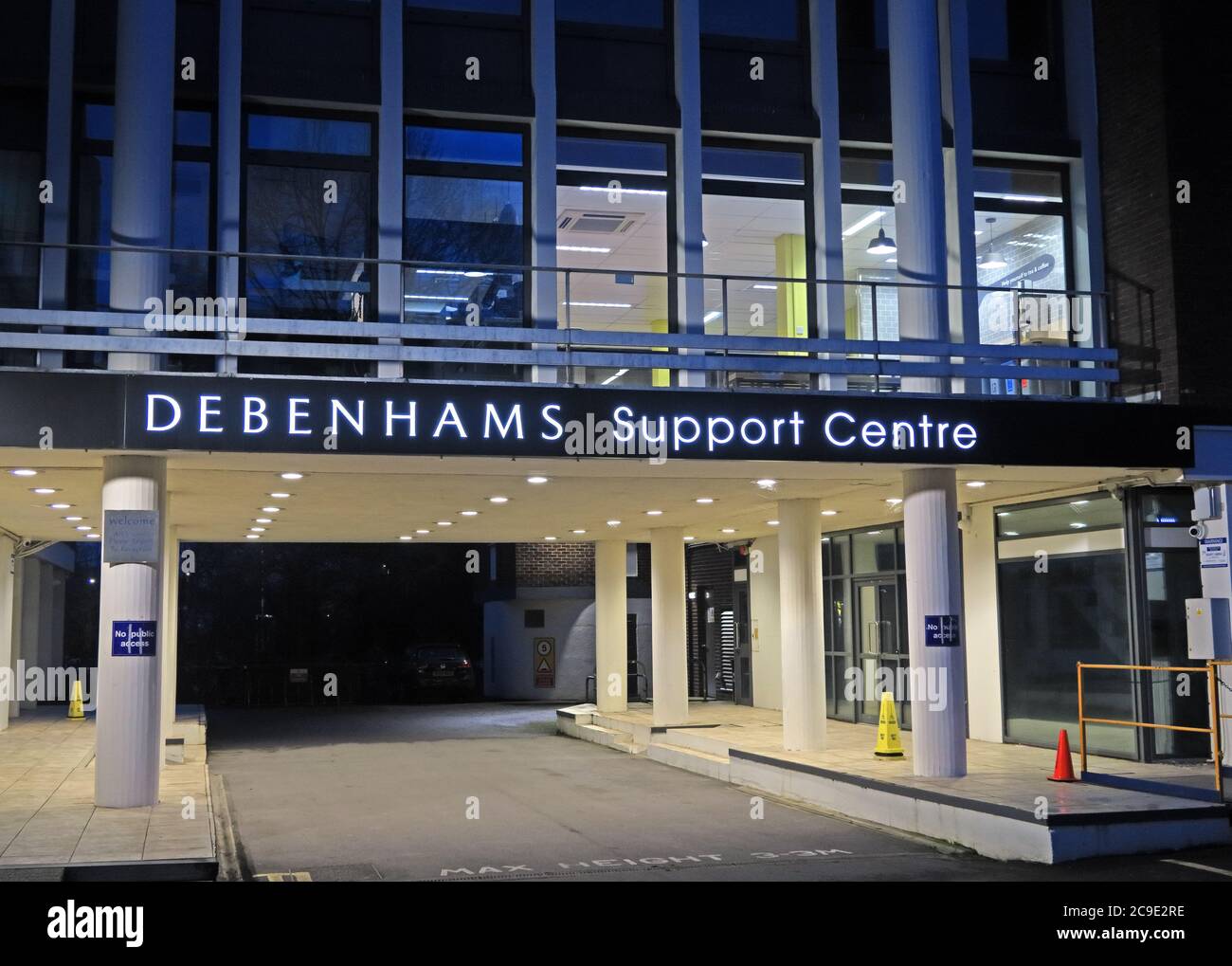

Debenhams Support Centre,high street retail,Bedford House, Park St, Taunton TA1 4DB at dusk

Image details

Contributor:

Tony Smith / Alamy Stock PhotoImage ID:

2C9E2REFile size:

53.2 MB (2.1 MB Compressed download)Releases:

Model - no | Property - noDo I need a release?Dimensions:

5100 x 3648 px | 43.2 x 30.9 cm | 17 x 12.2 inches | 300dpiDate taken:

7 February 2019Location:

Bedford House, Park St, Taunton,Somerset,England,UK, TA1 4DBMore information:

Debenhams prepares to file for bankruptcy April 2020 Chain buckling under coronavirus shutdown just a year after it was rescued & considering filing a formal notice of intention to appoint administrators. Debenhams is preparing to call in administrators after the struggling department store was forced to close all its outlets under the coronavirus lockdown. The company, which has 22, 000 staff and was rescued by its lenders after collapsing into administration only a year ago, is understood to be considering filing a formal notice of intention to appoint administrators next week. The legal process provides protection from creditors for 10 working days while a company tries to secure a rescue deal. Potential administrators lined up this time include KPMG, which handled the Debenhams restructure last May. A Debenhams spokesman said: “Like all retailers, we are making contingency plans reflecting the extraordinary current circumstances. Our owners and lenders remain highly supportive and whatever actions we may take will be with a view to protecting the business during the current situation.” They added: “While our stores remain closed in line with government guidance, and the majority of our store-facing colleagues have been furloughed, our website continues to trade and we are accepting customer orders, gift cards and returns.” It is understood that the potential insolvency measure would be intended to protect the business so it could continue to trade. Debenhams was taken over last year by a group of its financial backers, including the US hedge funds Silver Point and GoldenTree, after falling into administration. It then used an insolvency process known as a company voluntary arrangement (CVA) to cull unprofitable sites and cut rents. The group has closed 22 stores, 19 of which shut in January, resulting in more than 700 job losses. A further 28 of its remaining 141 stores had been lined up for permanent closure next year.